A balance sheet is a type of financial statement used in business and finance to give an overview of a company’s assets, liabilities, and shareholder equity at a given point in time. These balance sheets are essential tools for business owners, accountants, and investors because they provide insight into a company’s financial standing and show information that is key to assessing a business’s past, current, and future performance.

In this guide, we’ll go over:

- Balance Sheet Definition

- Balance Sheet Accounts and Components

- Balance Sheet Example

- Balance Sheets vs. Other Financial Statements

- Showing You Understand Balance Sheets on Resumes

Showcase new skills

Build the confidence and practical skills that employers are looking for with Forage’s free job simulations.

Balance Sheet Definition

Balance sheets give a quick overview of a company’s financial standing. A balance sheet is a financial statement that shows a company’s assets for a given period, such as a quarter or fiscal year. The sheet then explains how those assets are financed, either through liabilities (debts), equity (the sale of stocks and bonds), or a mix of both.

A balance sheet has two sides: assets on one and liabilities and equity on the other. The foundation of this type of financial statement is the accounting equation, where total assets must equal the sum of liabilities and equity:

Assets = Liabilities + Equity

If these two sides don’t balance, there has been a mistake in the company’s accounting, or transactions are not properly recorded.

Who Uses Balance Sheets?

All public companies must use balance sheets and periodically file them with the U.S. Securities and Exchange Commission (SEC). Private companies don’t need to file anything with the SEC but may still use balance sheets since they’re a simple way to look at a business’s financial standing at a point in time.

Balance sheets for public companies in the U.S. must adhere to generally accepted accounting principles (GAAP). Private companies aren’t required to follow GAAP standards, but some do for the sake of consistency, especially if there are plans to go public in the future.

Accountants and corporate finance teams are responsible for making balance sheets and other financial statements like cash flow statements. However, accountants and other financial team members also use these sheets to quickly calculate company performance metrics, like the current ratio.

Other finance professionals, like investment banking analysts, rely on the details in these statements for things like business valuation, weighing investing options, and tracking historical data to predict future company performance.

>>MORE: See the top accounting skills you need on your resume.

Balance Sheet Accounts and Components

The three main accounts of a balance sheet are assets, liabilities, and equity, but there are different accounts within these sections, too.

Assets

Balance sheets show both current and non-current assets.

Current assets are very liquid — they can be converted to cash quickly. These are also short-term assets that the company will likely use or sell within a year. Current assets include things like:

- Cash

- Checking and savings account balances

- Certain marketable securities (like stocks)

- Accounts receivable (money customers owe the company)

- Inventory

Non-current assets are also called fixed assets. These are long-term resources that are not easily converted into cash. Non-current assets include:

- Long-term securities like bonds

- Real estate

- Machinery and equipment

- Copyrights and patents

The end of the assets portion shows the overall total assets.

Liabilities

A company’s current and non-current liabilities are listed on the balance sheet.

Current liabilities are short-term debts the company expects to pay within a year. Some common examples of current liabilities are:

- Accounts payable (money the company owes customers, suppliers, or lenders)

- Deferred revenue (money a customer has paid before receiving a product or service)

- Commercial paper (short-term debt used to finance pressing needs, like payroll and inventories)

- Utility costs

Non-current liabilities are long-term debts the company does not need to pay within the following year. Non-current liabilities include:

- Long-term loans

- Deferred taxes

- Long-term leases

- Bonds payable (bonds the company must pay a buyer for once the bond reaches maturity)

The company’s total overall liabilities are listed at the end of the liabilities section.

Shareholder Equity

A company’s shareholder equity is the amount of money invested in the company by owners or shareholders, usually by buying stocks. The shareholder’s equity section of a balance sheet shows the current value of the company’s common stock and includes information about financial gains and losses directly relating to equity. For example, the statement may show:

- Retained earnings (money the company reinvested into the business or distributed to shareholders as dividends)

- Accumulated deficit (the company has more debt than profit, leading to a negative retaining earnings account and no spare profit to reinvest or distribute as dividends)

- Accumulated other comprehensive income or loss (income or losses from foreign currency translation adjustments and unrealized gains or losses from bonds and hedge fund investments)

The total shareholder’s equity is listed at the end of the section. Typically, a line will also show that the sum of liabilities and equity equals total assets.

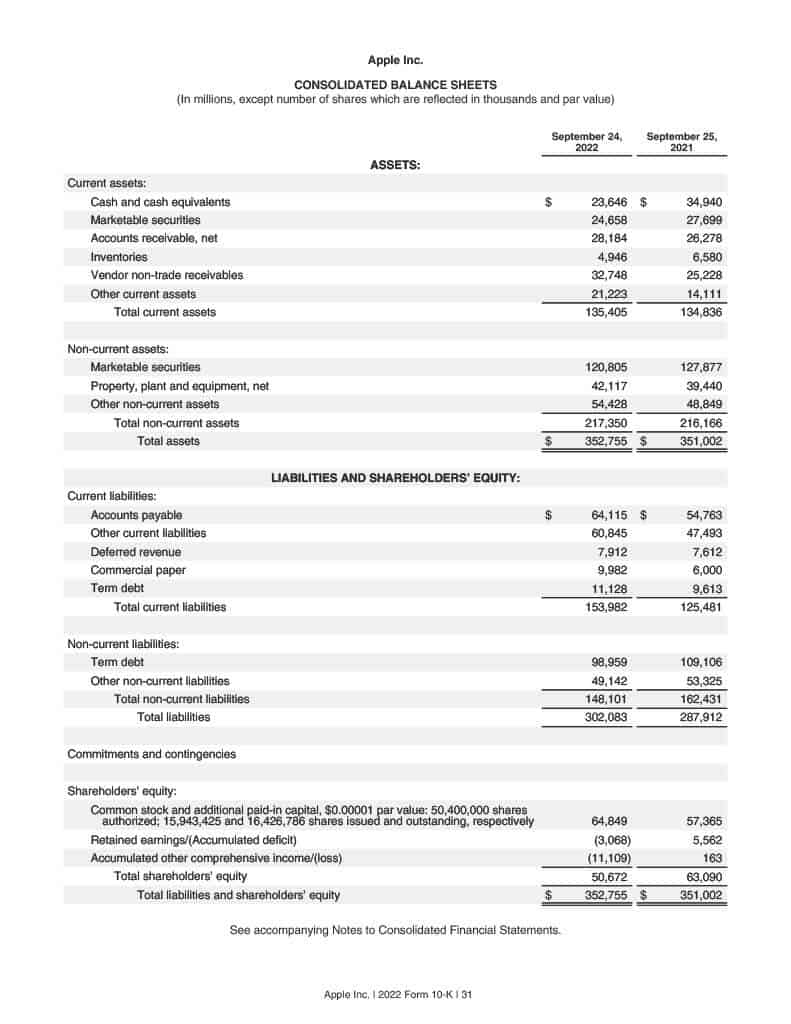

Balance Sheet Example

Let’s look at an example using Apple’s consolidated balance sheet for the fiscal year 2022.

How to Read a Balance Sheet

For public companies based in the U.S. that follow GAAP guidelines, all accounts are listed from most to least liquid (most easily converted to cash to least easy to convert). However, non-U.S. companies typically use International Financial Reporting Standards (IFRS) when making balance sheets, which requires listing accounts in the opposite order, from least to most liquid.

A balance sheet shows the three main accounts (assets, liabilities, and equity) and compares the balances against previous periods. For example, an annual sheet will usually compare current balances to the prior year, and quarterly statements contrast the same quarter from the previous year.

It is also important to remember that fiscal years don’t always run from Jan. 1 to Dec. 31. Companies can choose to adjust their fiscal year to work around peak business seasons, like Christmas shopping times or summer holidays. For example, Apple’s fiscal year ends in September, and Microsoft ends its in June.

Balance Sheets vs. Other Financial Statements

Balance sheets are only one type of financial statement. The other core financial statements used in corporate finance and accounting are cash flow statements and income statements.

- Cash flow statements: A cash flow statement shows a company’s transactional activities by tracking incoming and outgoing money for a given period of time. Cash flow statements detail these cash flows for investing, financing, and operating activities.

- Income statements: An income statement explains a company’s revenue streams and expenditures for a specific time frame and shows how gross revenue is transformed into net profits.

These statements give an overview of a company’s operations and financial performance for the specified time period. Also, investors, analysts, and potential creditors can use these statements to understand how a company makes and uses its money.

Showing You Understand Balance Sheets on Resumes

Understanding what a balance sheet is and how to read one is crucial for many careers in finance. This financial statement provides invaluable information needed for completing various financial calculations and formulas. Because you need to use balance sheets for these calculations, showing you know these metrics and formulas implies an inherent knowledge.

Some equations and analyses that rely on balance sheets include:

- Current ratio

- Quick ratio

- The accounting equation

- Net working capital

You can list these formulas in your skills section to imply your knowledge of balance sheets, or you can list “financial statements” as a skill on its own. Additionally, you can use the description section for prior work or internship experience to talk about times when you created or used financial statements in a professional setting.

Explore what a career in finance is really like with Forage’s finance virtual experience programs.

Image credit: kantver / Depositphotos.com