Revenue is the amount of money a company makes from selling goods or services. Companies typically report their revenue on financial statements, like income sheets, and finance professionals rely on revenue to determine a business’s profitability. For straightforward business models, companies can calculate revenue fairly easily, but the more complex the business, the harder revenue is to determine.

Revenue Definition

Revenue, also called income, is the total amount of money a company brings in. Sometimes people confuse revenue with profits, but it’s best to think of revenue as sales: how much money the company brings in by selling goods, products, or services. Profit accounts for operating expenses, such as the overhead cost of products, marketing, and rent: how much money is left over after covering operating costs?

Companies track revenue on financial statements, like income sheets and cash flow statements. Financial regulations require some types of companies, like public companies, to report revenue on quarterly and annual bases on earnings reports.

New York Jobs CEO Council Financial Analyst

Analyze a company's financials as an analyst on a technology team in this free job simulation.

Avg. Time: 2 to 3 hours

Skills you’ll build: Financial analysis, critical thinking, problem solving, Excel, communication

Who Needs to Understand Revenue?

While many careers in finance involve working with revenue, accountants are responsible for calculating, tracking, and reporting a company’s revenue and other financial metrics, such as profit margins.

Other finance and business roles that require understanding revenue include:

- Financial analysts and business analysts often use revenue when reviewing a business’s financial position.

- Investment bankers use revenue to inform investing decisions.

- Private equity analysts and budget analysts encounter revenue in financial statements and use it as part of their analysis and decision-making process.

Types of Revenue

Revenue is the total amount of money a company brings in from selling goods or services, but there are different types of revenue, depending on the source of the money or the transaction process.

Operating Revenue

Operating revenue, or operating income, comes from the company’s primary source of revenue. For example, if an automotive manufacturing company also occasionally sells merchandise, its operating revenue is the income from its primary source: cars. (Check out our guide to Ford internships!)

Non-Operating Revenue

Non-operating revenue is income from anything other than the company’s primary source of funds. So, like the above example, an auto manufacturer that sometimes sells merchandise counts revenue from merchandise sales as non-operating revenue.

Accrued Revenue

Accrued revenue, sometimes called deferred revenue, occurs when a company has made a sale but hasn’t received payment from the customer. The sale is counted as revenue, even though the money doesn’t actually exist yet in the company’s bank account. Accrued revenue can happen if there’s a trial period before full payment is due from the customer, or from delayed interest on investments.

Unearned Revenue

The opposite of deferred or accrued revenue is unearned revenue: when a customer has paid for a product or service but hasn’t received it yet, the company includes the payment as unearned revenue. On financial statements, accountants record this type of revenue as a liability because it’s essentially a debt the company owes to a customer. For instance, unearned revenue includes situations like if a contractor takes payment for a bathroom renovation up front before they finish the work.

Gross Revenue

Gross revenue, or total revenue, is the sum of all money a business generates from its income sources. When calculating gross revenue, accountants and financial analysts include discounts on or returns of products and goods, but don’t take into consideration operating expenses or taxes.

Net Revenue

Net revenue is the same as net income — it shows how much money a company collects from sales after subtracting all expenses, cost of goods sold, depreciation, interest, and taxes.

What Career Is Right for You?

Trying to decide what path to take? Find out what career is right for you with our free quiz.

How to Calculate Revenue

Calculating revenue for companies that sell only one or two products or services is straightforward — multiply the number of products sold by their sales price. The formula for calculating revenue is:

Revenue = # of Units Sold x Cost Per Unit

Some companies may use the average sales price per unit, but that won’t give you an exactly accurate number. Ultimately, it can be complicated to calculate revenue depending on the type of business and the type of accounting.

Calculating Revenue by Accounting Type

In the accrual basis of accounting, accountants count revenue even if the company hasn’t received cash from the sale. So, if a company sold $500 of products in March, but it allows deferred payments until April, the company would still report $500 of revenue for March.

The other method to approach accounting is the cash basis of accounting, wherein a sale only counts as revenue once the company receives and processes the payment.

Choosing which accounting method is largely up to the business and its financial team. However, the Internal Revenue Service (IRS) and Securities and Exchange Commission (SEC) regulations require certain large companies (revenue over $5 million per year) and all public companies to use the accrual basis of accounting.

KPMG Career Catalyst: Tax

Explore the world of tax accounting and build skills employers are looking for with this free job simulation from KPMG.

Avg. Time: 3 to 4 hours

Skills you’ll build: Tax research, technical writing, critical thinking, data modeling, manipulating data, Excel modeling, effective communication, team building, tax types

Calculating Revenue by Business Model

Calculating revenue becomes more difficult if the business is larger or more complex. Some straightforward business models can use the “number of units multiplied by cost per unit” formula to calculate revenue. However, most companies must consider things like returns, refunds, discounts, currency conversion rates, and pricing for different products in their calculations.

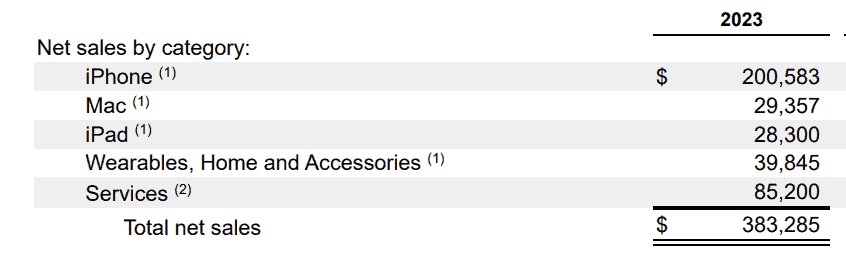

This is a simplified example, but on Apple’s 2023 annual earnings report, we can see that Apple has a variety of products, each sold at different prices. These product sales often include discounts and returns, too. Accountants must carefully calculate revenue for each product to ensure they report everything accurately.

Showing You Understand Revenue on Your Resume

Understanding revenue and how to calculate it is a core skill for accountants and business professionals. Ultimately, if you have previous work experience or internships in accounting, employers will likely assume you know what revenue is.

You can also mention your familiarity with financial statements since revenue is a key piece of these reports. Additionally, if you don’t have any professional experience using revenue or financial statements, you can talk about your experiences with them in school or your personal life. For instance, include experiences like calculating revenue for a friend or family member’s small business. Your cover letter is a great spot to go into detail about any personal or professional accounting experience.

Including relevant and practical accounting skills can also let employers understand the breadth of your knowledge. Some important skills to include on your resume are:

- Familiarity with financial statements

- Experience calculating vital accounting and business formulas, like profit margins, the accounting equation, and quick ratios

- In-depth knowledge of the generally accepted accounting principles (GAAP)

Start learning these skills and more with our free accounting job simulations.

Image credit: Canva