A P&L statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. Finance professionals often use P&L statements in investment banking, corporate finance, accounting, and small business decisions.

P&L Meaning

P&L stands for profit and loss — a P&L statement details a company’s financial position for a given accounting period, such as a quarter, month, or year. Put simply, this statement shows the company’s profits and losses for the period.

Sometimes, finance professionals call P&L statements income statements since the term profit is interchangeable with net income. Other names you might hear for a profit and loss statement include:

- Expense statement

- Earnings report

- Earnings statement

- Statement of financial income

- Statement of finance results

- Statement of operations

P&L Statement Uses

A P&L statement shows a company’s overall financial health — how much profit it has made, how much it costs to make that profit, and any financial losses the company sustained. This information is vital for businesses, investors, and financial analysts to inform decisions like budgeting, investing, or business structure changes.

Through careful P&L management, business leaders and finance professionals can make smart business choices to adjust spending on expenses and improve revenue. Financial analysts rely on P&L management to determine where they can cut costs, source opportunities to boost sales, and track profits.

NY Jobs CEO Council Financial Analyst

Practice analyzing company financial statements in this free job simulation from the NY Jobs CEO Council.

Avg. Time: 2 to 3 hours

Skills you’ll build: Financial analysis, critical thinking, problem solving, Excel, communication

Other professionals that use P&L statements and P&L management include:

- Investment bankers, when analyzing potential companies for mergers or acquisitions

- Legal professionals in commercial law, when performing due diligence on corporate transactions

- Budget analysts, when crafting spending plans for companies

- Accountants (both internal accountants and certified public accountants), when summarizing and reporting company financials

- Auditors, when reviewing and verifying a company’s finances

Profit and Loss Statement Example

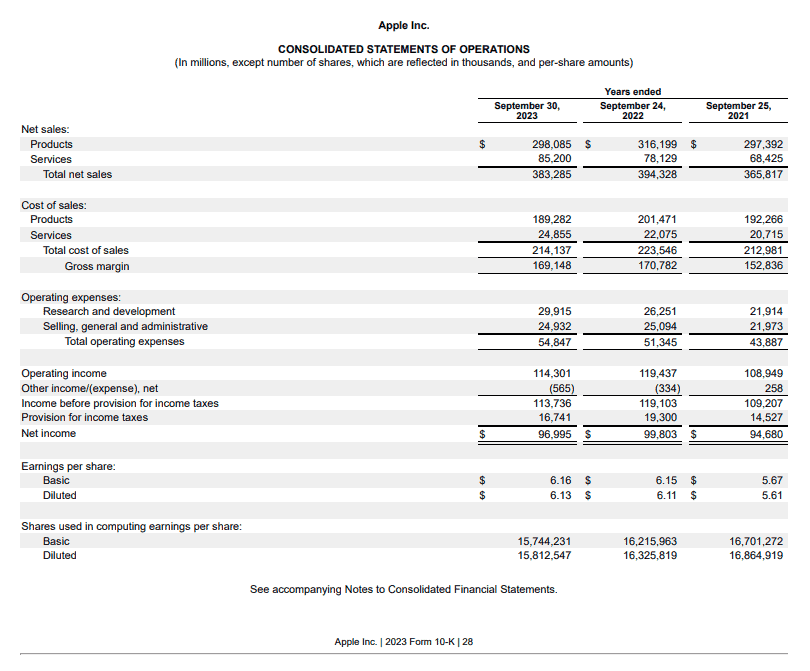

Let’s take a look at a real-world example of a P&L statement from Apple’s 2023 annual report. Apple refers to this sheet as their “consolidated statement of operations” — it’s consolidated because it encompasses the entire fiscal year of 2023.

See Apple’s full annual report for 2023.

Profit and Loss Statement Components

Using Apple’s consolidated statement of operations, we can look at the different financial metrics included in P&L statements:

Revenue

Revenue is another word for net sales and represents how much money a company earns from selling goods or services.

COGS

COGS, or cost of goods sold (called cost of sales in Apple’s statement), is how much the company spends on creating products to sell. Some expenses included in COGS are inventory, labor, raw materials, and marketing.

Gross Profit

Gross profit (or gross margin) is revenue minus the costs of goods sold.

Operating Expenses

OPEX or operating expenses are the costs associated with running a business and producing goods. OPEX includes expenses like COGS, rent, utilities, employee salaries, maintenance and repairs, advertising, and office supplies.

Operating Income

Operating income is a company’s profits after all operating expenses are deducted.

EBIT

Earnings before interest and taxes (EBIT) is a metric that determines how much money a company has in profit before interest and taxes are covered. A similar metric, EBITDA (earnings before interest, taxes, depreciation, and amortization), is also common on financial statements.

Net Income

A company’s net income is its profits after subtracting all operating expenses, taxes, depreciation, amortization, interest, and COGS.

Earnings Per Share

On financial statements, earnings per share (EPS) denotes the profits due for each outstanding share of common stock. This dollar amount is how much each investor will receive per their number of shares in the business.

Free Career Aptitude Test for Students

What career is right for you? Take this free quiz to find out!

P&L Statements vs. Other Financial Statements

Corporate finance and accounting professionals rely on more than just profit and loss statements when analyzing a company’s financial health. They also use:

- Cash flow statements: A cash flow statement details a company’s transactional activities. Cash flow statements explain cash in and out for financing, investing, and operating activities.

- Balance sheets: A balance sheet shows a business’s assets and describes the financing for each via equity, debt, or combinations of the two.

Together, these three statements give an overview of a company’s assets, how those assets affect revenue, and how well the company manages to balance the cost of production with revenue.

Showing You Understand P&L on a Resume

One way to show potential employers that you understand P&L statements is by mentioning financial formulas, metrics, and business valuation methods that rely on P&L and other financial statements.

Some examples of these formulas or metrics you can mention include:

- Current ratio

- Quick ratio

- Net working capital

- Discounted cash flow (DCF) valuation

- Calculating net present value (NPV)

- The accounting equation

You can include these metrics and formulas in the skills section of your resume or in the description of a job or internship. Additionally, you can mention if your work experience involved creating financial statements.

Forage Resume Writing Masterclass

Learn how to write a resume that will get you noticed with this free masterclass from Forage.

Avg. Time: 5 to 6 hours

Skills you’ll build: Resume writing, professional brand, identifying job titles, professional narrative, transferable skills, industry keywords

If you don’t have any professional experience with financial statements, your cover letter is a great place to describe your familiarity with these concepts. For instance, mention if you helped a friend or family member compile financial statements for their small business or took an accounting course focused on building and analyzing a business’s finances.

Learn the skills employers are looking for and get noticed by top recruiters with Forage’s free accounting job simulations.

Image credit: Canva