Discounted cash flow (DCF) valuation is a type of financial model that determines whether an investment is worthwhile based on future cash flows. A DCF model is centered around the idea that a company’s value is determined by how well it can generate cash flows for its investors in the future.

What Is DCF Used For?

A discounted cash flow valuation is used to determine if an investment is worthwhile in the long-run. For example, in investment banking, financial analysts use DCF analysis to determine if a potential merger or acquisition is worth it. DCF valuation is also used in real estate and private equity.

Outside of corporate finance, DCF valuations can help business owners make budget decisions and determine their own company’s projected value.

JPMorgan Investment Banking

Learn how investment bankers prepare and analyze DCF models with this free Forage job simulation.

Avg. Time: 3 to 4 hours

Skills you’ll build: DCF modeling, M&A screening, company analysis, strategic rationale, client communication, presentation

How Do You Do a Discounted Cash Flow Valuation?

A core principle of finance is that $10 today is worth more than $10 a year from now. This principle is the “time value of money” concept and it’s the foundation for DCF analysis. Projected future cash flows must be discounted to present value so they can be accurately analyzed.

>>MORE: Gain the skills you need to land an internship at a top firm with our picks for the best investment banking job simulations on Forage.

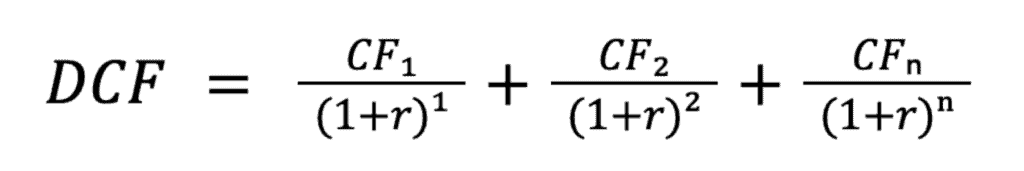

What Is the DCF Valuation Formula?

When doing a DCF valuation, you must consider: the discount rate, the cash flows, and the number of periods.

Where:

- CF₁ = Cash flow for the first period

- CF₂ = Cash flow for the second period

- CFₙ = Cash flow for “n” period

- n = Number of periods

- r = Discount rate

Components of the DCF Formula

Cash Flow (CF)

Cash flow is any sort of earnings or dividends. Cash flows can include revenues from the sales of products or services or cash from selling an asset.

Number of Periods (n)

The number of periods is however many years the cash flows are expected to occur. Typically, the number of periods is 10, as this is the average lifespan of a company. However, depending on the company itself, this period could be longer or shorter.

Discount Rate (r)

The discount rate brings future costs to present value. Oftentimes, the discount rate is the company’s cost of capital, or how much the company must make to justify the cost of operation. This cost is typically the weighted average cost of capital (WACC), which is usually the company’s interest rate and loan payments or dividend payments to shareholders.

Citi Investment Banking

Explore how investment bankers use DCF and financial analysis to evaluate acquisition targets in this free job simulation from Citi.

Avg. Time: 5 to 6 hours

Skills you’ll build: PowerPoint Enterprise value, company research, Excel, financial modeling, forecasting, valuation, comparison analysis, critical thinking, reading comprehension

DCF Valuation Example

Let’s say you have a company, and you want to start a big project. Your company’s weighted average cost of capital is 8%, so you’ll use 8% for your discount rate. The project is set to last for five years, and your company needs to put in an initial investment of $15 million.

- Year 1: $1 million

- Year 2: $2 million

- Year 3: $5 million

- Year 4: $5 million

- Year 5: $7 million

So, using these future cash flows and your 8% discount rate, your yearly discounted cash flows are:

| Year | Projected Cash Flow | Discounted Cash Flow* |

| 1 | $1,000,000 | $925,926 |

| 2 | $2,000,000 | $1,714,678 |

| 3 | $5,000,000 | $3,969,161 |

| 4 | $5,000,000 | $3,675,149 |

| 5 | $7,000,000 | $4,764,082 |

To determine if this project is a worthwhile investment, we need to compare the initial investment to the sum of the discounted cash flows over the lifetime of the project.

- Initial Investment: $15,000,000

- Discount cash flow sum: $15,048,996

- Net present value for project: $48,996

The net present value is found by subtracting the initial investment cost from the sum of the discounted cash flows. The net present value is a positive number, meaning that the money generated by the project is more than the initial investment. Ultimately, this project would be at least mildly profitable.

Bank of America Investment Banking

Explore working at Bank of America and learn banking skills like DCF valuation with our free job simulation.

Avg. Time: 4 to 5 hours

Skills you’ll build: DCF valuation, equity capital markets (ECM), debt capital markets (DCM), SWOT analysis, financial analysis, communication

How to Show DCF Skills on Your Resume

DCF valuation is a type of financial model used by many finance professionals. There are two key ways you can highlight DCF skills on your resume:

- Skills section: Because DCF valuation involves using financial modeling, you can list “financial modeling” in your skills section. You can also include DCF specifically.

- Work or internship experience section: You can mention an instance where you created a DCF model as part of prior work or internship experience.

Your cover letter is a great place to mention DCF analysis if you don’t have any professional experience using it. In your cover letter, you can explain situations you’ve used DCF analysis outside of the classroom or work. For instance, you can talk about a time you used DCF valuation to help a friend or family member project the value of an investment.

>>MORE: Learn more investment banking skills you need on your resume.

Related Skills

DCF valuation is a core skill for many finance professionals, including investment bankers. Some other useful skills for a career in finance include:

- Calculating the weighted average cost of capital (WACC)

- Using Excel

- Completing a comparable company analysis

- Understanding debt capital markets

You can learn these skills (and more!) using Forage’s free banking and financial services job simulations.

FAQ

Yes, DCF models can provide intrinsic values for businesses and assets. However, the model is based on assumptions and estimations, so it can never be truly accurate. A DCF model relies on how well the discount rate or weighted average cost of capital (WACC) is calculated, and this metric can be tricky to determine. Analysts should always use DCF models in conjunction with other approaches, such as comparable analysis and price-to-earnings (P/E) ratios.

No, but they are closely related! Net present value (NPV) is often the final step in a discounted cash flow (DCF) analysis. You calculate an investment’s NPV by subtracting the initial investment from the sum of the investment’s discounted cash flows.

Weighted average cost of capital (WACC) is often used as the discount rate in a DCF model. WACC is the rate a company must pay (to lenders and shareholders) to justify operations. If the company brings in less money than this threshold, it can’t reliably sustain itself.

DCF valuation is not a great tool for determining the value of banks and financial institutions. Rather than re-investing positive cash flows into the business, banks typically use those funds to create products. So, a DCF model can’t accurately predict future cash flows. Additionally, DCF models are unreliable for companies that keep much of their financial activity private. Without information about a company’s capital structure and investing activity, it is difficult to calculate WACC, making a DCF model less dependable.

Image credit: videoflow / Depositphotos.com