CAGR, which stands for compound annual growth rate, is the rate at which an investment grows. Finance professionals calculate the CAGR for investments between two points in time (typically years or months) to understand how well the investment performed in that period. Compound annual growth rates are useful for comparing the historical performance of investments and predicting future performance.

What Is CAGR?

CAGR represents an investment’s historical performance over a specific time period. But, what does CAGR stand for? CAGR means compound annual growth rate, and these growth rates are particularly useful for finance and investment professionals:

- Investment bankers rely on it to compare historical returns of company stocks.

- Private equity professionals gauge how well an asset performs compared to similar investment options.

- Portfolio managers calculate it to judge the performance of investment portfolios.

- Financial analysts consider it along with related metrics when assessing investment and business decisions.

Typically, investors use CAGR retrospectively to understand past performance. However, if an investment has a relatively stable growth rate, investors may use its growth rate, along with other financial metrics,to predict future returns. CAGR can be misleading, though.These growth rates only show a “smoothed” rate of return — they don’t reflect high peaks or low valleys in the investments’ real history.

Citi Investment Banking

Build the investment analysis skills you need to get hired in this free job simulation from Citi.

Avg. Time: 5 to 6 hours

Skills you’ll build: PowerPoint, enterprise value, company research, Excel, financial modeling, forecasting, valuation, comparison analysis, critical thinking, reading comprehension

How to Calculate CAGR

When calculating CAGR, it’s important to remember the assumptions and limitations of this metric:

- CAGR assumes compounded growth, meaning any return on the investment is reinvested. For example, if you start with a $100 investment and after the first year see a return of $20, that $20 is also invested and gains returns.

- CAGR offers a rate of return over a specific period of time. So, if you use CAGR to compare two different investments, you must use the same time period for both calculations.

- CAGR gives a smoothed out rate of return, so any inherent risks or volatility will not be represented.

CAGR Formula

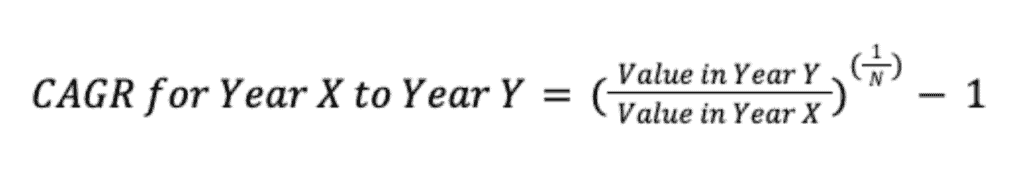

The compound annual growth rate formula consists of: the chosen time frame (we’re using years), the investment’s value at both points or years, and the number of years in between.

The compound annual growth rate formula looks like this:

Components of CAGR Formula

- Year X to Year Y: the period you want to look at

- Value in Year Y: the value for the end of the time period

- Value in Year X: the value for the beginning of the time period

- N: the number of years between year X and year Y

Bank of America Investment Banking

Apply your investment analysis and communication skills to advise clients as part of BofA's Technology, Telecom & Media Investment Banking team in this free job simulation.

Avg. Time: 4 to 5 hours

Skills you’ll build: SWOT analysis, financial analysis, M&A screening, cross-team collaboration, ECM & DCM, financial modeling, DCF valuation, communication, presentations

Example CAGR Calculation

Let’s say you invested $500 in January 2018. By December, your investment was worth $2,000. But, by December 2019, it dropped to $400. Then, by December 2020, it grew to $1,750.

To determine the growth rate between January 2018 and December 2020, your components for the CAGR formula would be:

- Value in Year Y (December 2020): $1,750

- Value in Year X (January 2018): $500

- N: 3 years

Our N is three because the first year (2018) is included as one full year. So, we include all of 2018, 2019, and 2020 for a total of three full years of investing.

Using the formula from above with these numbers, we have:

CAGR = ($1,750/$500) ^ (1/3) – 1

CAGR = 52%

The compound annual growth rate for this investment is 52% between 2018 and 2020. A 52% growth rate is positive, but this example highlights one of the key problems with using CAGR to evaluate investments: It ignores how volatile the investment was throughout that time.

While the investment ultimately resulted in a $1,250 return over three years, there was also significant loss in the second year. CAGR can be great to look at overall performance, but it isn’t a good metric of the volatility or risk involved with an investment.

JPMorgan Investment Banking

Practice analyzing investments as a junior investment banker in this free job simulation from JPMorgan.

Avg. Time: 3 to 4 hours

Skills you’ll build: M&A screening, cross-team collaboration, company analysis, strategic rationale, M&A process understanding, modelling, DCF, presentation

How to Show CAGR Skills on Your Resume

You can group CAGR together with other investment analysis skills on your resume. For instance, you can list calculating growth rates alongside related skills, like discounted cash flow (DCF) analysis or internal rate of return (IRR) calculations in your resume’s skills section..

If you performed CAGR calculations as part of prior work or internship experience, you can mention that in the description of the job or internship. For example, you could say, “performed CAGR calculations on multiple investment portfolios to track performance.”

If you haven’t calculated growth rates in a professional or academic setting, your cover letter is a great place to explain your familiarity with investment analysis. Perhaps you’ve analyzed your own investments in the S&P 500 or helped a friend compare potential investment options using metrics like CAGR. Describe your analysis experience and how it relates to the job.

Forage Resume Writing Masterclass

Learn how to write a resume that will get you noticed with this free masterclass from Forage.

Avg. Time: 5 to 6 hours

Skills you’ll build: Resume writing, professional brand, identifying job titles, narrative, summary, professional profile, transferable skills

Related Investing Skills

CAGR is an important tool for anyone who has investments, but it’s especially useful for finance professionals. Other crucial skills financial professionals need include:

- Completing comparable company analyses

- Using Excel to make quick and accurate calculations

- Calculating metrics of profitability, like profit margins and contribution margins

- Understanding investment terms and topics, such as common stocks

- Performing technical analysis on stocks

You can learn these skills (and more!) with Forage’s Investment Banking Career Path.

Image credit: Canva