An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by companies (like buying a new piece of machinery). While some people may track their personal expenses for budgeting purposes, businesses and accountants have strict guidelines on what counts as an expense.

In this guide, we’ll cover:

- Expenses Definition

- Types of Expenses

- Expenses Example

- Expense vs. Expenditure

- Showing You Understand Expenses on Resumes

- Related Finance Skills

Showcase new skills

Build the confidence and practical skills that employers are looking for with Forage’s free job simulations.

Expenses Definition

The simplest definition of an expense is any money spent to get something. For individuals, expenses are common: we all have living expenses like rent or mortgages, utility bills, and groceries.

In business, though, expenses are more strictly defined. This is because businesses can claim certain things as deductions on their taxes, so the U.S. Internal Revenue Service (IRS) has specific guidelines on what does and does not count as a business expense. By IRS standards, a deductible business expense must be both ordinary (typical for the business’s industry) and necessary (helpful for the business’s functions).

How Are Expenses Reported?

Businesses often use expense reports to compile and track expenses, which are then formally reported by accountants on financial statements, like the income statement. However, when an expense is reported depends on the type of accounting the business uses: the accrual basis or the cash basis of accounting.

- In the accrual basis of accounting, the expense is recorded when the transaction occurs, even if money has yet to be exchanged. For example, if a business prepaid a hotel reservation for a business trip, that entire transaction is recorded as a business expense on the day it is booked, even if the money is not charged to the account until check-out.

- On the other hand, cash basis accounting records expenses once money has been exchanged. So, if a business uses this method and books a hotel reservation, it wouldn’t mark that transaction as an expense until the money is withdrawn from its accounts by the hotel.

Anyone in a business or organization can make expenses, but accountants and finance teams are responsible for tracking and reporting these transactions. For this reason, accountants need to understand the role of expenses in a company’s finances, the IRS’s tax regulations on them, and the generally accepted accounting principles (GAAP) surrounding how these transactions are recorded and reported.

>>MORE: Experience how accountants review expenses as part of a company’s finances with KPMG’s Career Catalyst: Audit Virtual Experience Program.

Types of Expenses

Operating

A company’s operating expenses include any costs associated with running the business day-to-day. They range from rent and utilities to research and development. Any money spent on the business’s core function is an operating expense.

Non-Operating

Non-operating expenses are the opposite of operating expenses — costs that are not directly related to a business’s core function. Common examples of non-operating costs include interest payments (the money is going to a lender and isn’t directly benefiting the business’s daily operations) and currency exchange costs (these are incidental expenses that do not go toward business operations).

Fixed

Fixed expenses stay the same regardless of the company’s production flow. Even if a company pauses production for a month, the company needs to pay for these things. These obligations include mortgages or rent, employee salaries, insurance costs, loan payments, and property taxes.

Variable

Variable expenses change regularly, typically because of increases or decreases in a company’s production. These are the opposite of fixed expenses. Variable costs include payroll for hourly employees, commission on sales, utilities, shipping costs, and certain raw materials. Essentially, if the cost isn’t exactly the same each time, it counts as a variable expense.

Accrued

Accrued expenses are transactions a company needs to pay, such as rent or mortgages, but has not yet paid. For example, if a company receives a shipment of raw materials used for production, but the supplier hasn’t yet sent an invoice for the transaction, the amount owed is an accrued expense.

Prepaid

A prepaid expense is the direct opposite of an accrued expense. Prepaid expenses are transactions the company has already paid for before receiving the product, good, or service. For example, if a company prepaid for a shipment of raw materials, but the supplier hasn’t delivered the materials yet, the amount paid is a prepaid expense.

Expenses Example

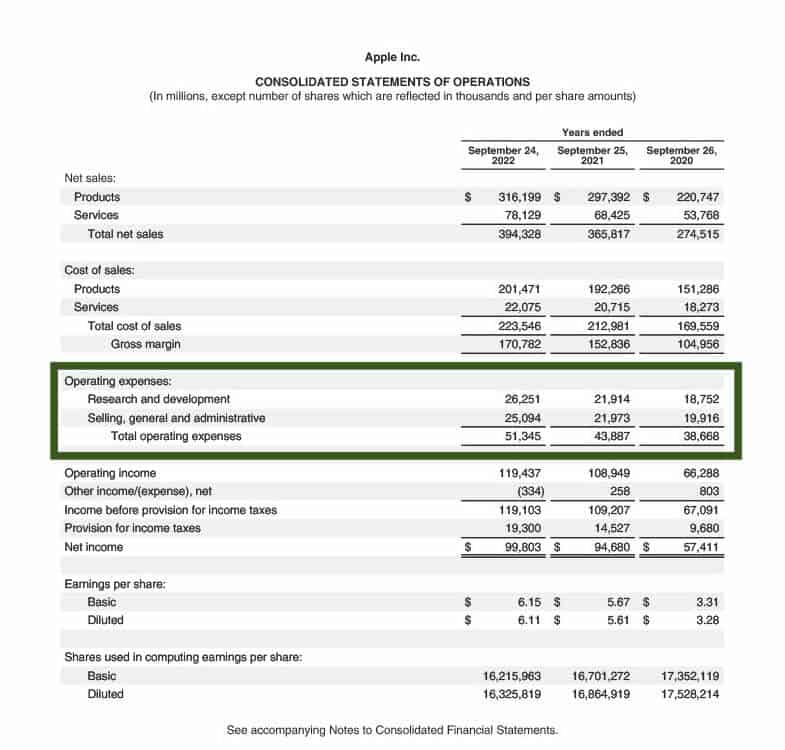

Using Apple’s 2022 year-end report, we can see how a business details its expenses on financial statements.

This consolidated statement of operations shows that Apple divides operating expenses into two categories: research and development and selling, general, and administrative. These two categories represent the type of daily expenses Apple typically incurs: staying ahead of the competition by investing in research and developing new products and the costs associated with selling its existing products.

How a company chooses to break up expenses on financial statements largely depends on the primary operating activities of the business. Some companies may divide operating expenses into even smaller categories, such as costs related to marketing activities or technology investments. Other companies may group all operating expenses together as one category, though.

Find your career fit

Discover if finance or accounting is the right career path for you with a free Forage job simulation.

Expense vs. Expenditure

The line between expenses and expenditures is subtle but important. Generally speaking, an expenditure is the total cost of a transaction, while an expense is that transaction’s offset to a company’s revenue.

A type of transaction that highlights this distinction is capital expenditures. Let’s say a company wants to buy a new production plant for $39 million. Rather than paying all at once, the company needs to capitalize this cost for tax purposes. So, the company spreads the $39 million out over the plant’s lifetime. Since buildings typically have a 39-year lifespan by IRS standards, the company would claim $1 million in expenses towards the building every year for 39 years.

The total cost of the plant ($39 million) is an expenditure, while each annual chunk of that cost ($1 million each year) is an expense.

>>MORE: Learn more about expenditures.

Showing You Understand Expenses on Resumes

Expenses are a daily occurrence in many business and accounting roles, so a potential employer would likely assume you understand expenses if you have prior work or internship experience in finance.

You can still mention expenses in the description of your work or internship experience, though. Some great ways to weave it into your resume include:

- Describing an instance where you compiled and created financial statements for a company

- Explaining how you innovated or improved a company’s expense reporting system

- Discussing a time when you caught a mistake on an expense report which prevented the company from a potentially disastrous tax season

Related Finance Skills

Accountants and business owners alike need to understand the role of expenses within a company’s finances. Other important things for business and finance professionals to know include:

- How to calculate profit margins

- The relationship between liabilities and assets

- The formula for determining a product’s contribution margin

- Financial statements like statements of cash flows

Explore these skills and more with Forage’s free accounting virtual experience programs.

Image credit: Canva